AI is no longer just a buzzword; it’s transforming how businesses operate, and automation in finance is leading the charge. From streamlining daily operations to making smarter decisions, companies are jumping on board with AI task automation to take their financial processes to the next level. The automation of finance processes isn’t just about saving time—it’s about cutting down on mistakes, slashing costs, and making everything run smoother.

So, why should businesses care about getting into AI financial management? Simply put, it’s a game-changer. Automating financial processes lets teams focus on what really matters, while tasks like invoice processing and financial reporting automation can be handled by AI. These tools, like robotic process automation in financial services, take the repetitive work off your hands, so your team can dig into more strategic projects.

But here’s the thing—not everything should be automated. While AI in finance is fantastic for certain tasks, some areas still need a human touch. Think about long-term planning or navigating tricky regulations. In this blog, we’ll break down which processes are perfect for automated finance and where you still need human oversight to make the best decisions.

Need smarter solutions? Contact Odin AI!

Recommended Reading

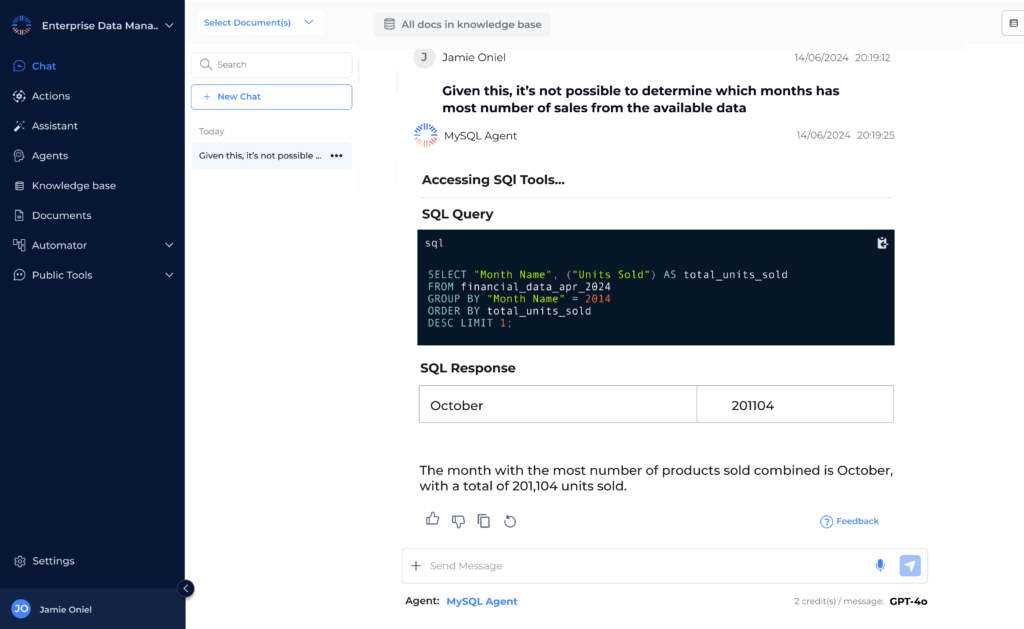

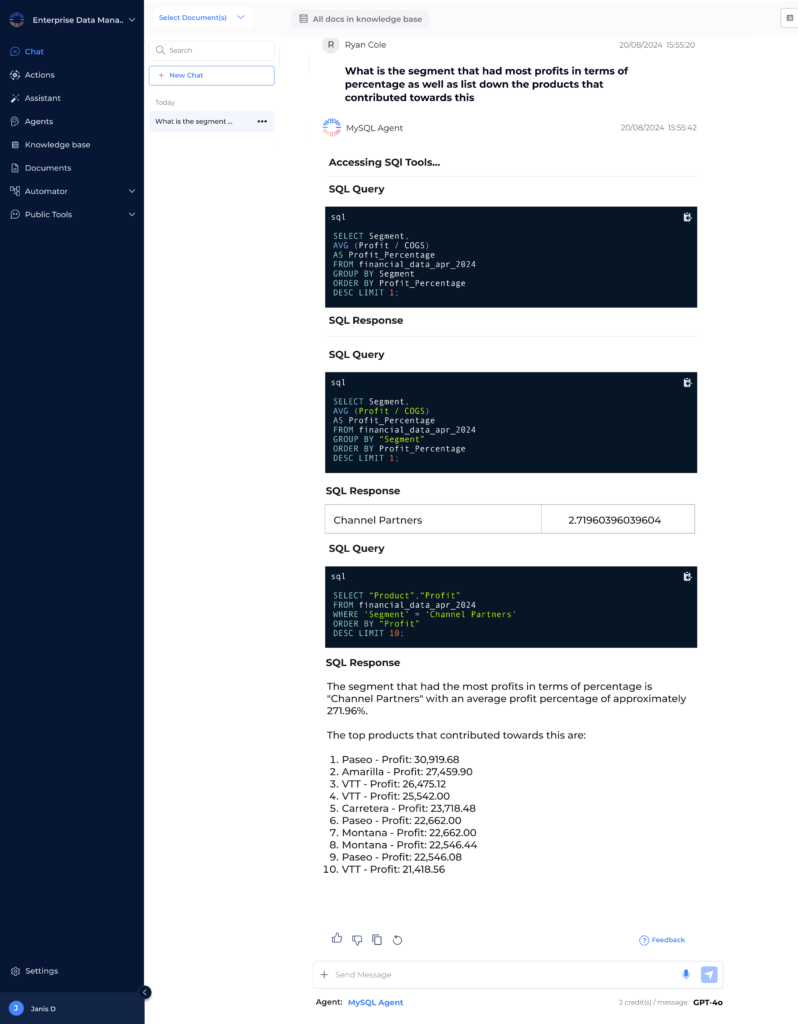

Financial Automation with Odin’s SQL Integration

Comprehending AI in Finance

What is AI in finance?

AI in finance is all about leveraging smart technologies like machine learning, natural language processing, and robotic process automation to handle financial operations that were once managed manually. The finance department plays a crucial role in managing these financial operations, with responsibilities including budget review and approval, and the automation of financial processes to enhance efficiency. From processing transactions to analyzing large sets of data, AI financial management has completely transformed the industry by introducing speed, precision, and scalability. These technologies are automating tasks like invoice processing, financial data automation, and even fraud detection, making financial operations smoother and more efficient. Automation in finance has become critical, helping businesses shift from manual processes to data-driven, automated workflows, enabling more informed decision-making.

Recommended Reading

MySQL Integration with Odin AI: Empower Your Knowledge Base

Financial Process Automation Technologies

Financial process automation technologies are at the forefront of transforming how businesses manage their financial operations. These technologies are designed to streamline and automate various financial processes, reducing manual effort and increasing both accuracy and efficiency. Key technologies in finance automation include:

- Robotic Process Automation (RPA)

RPA uses software robots to automate repetitive, rule-based tasks such as data entry and document processing, freeing up human resources for more strategic activities. - Artificial Intelligence (AI)

AI analyzes financial data, identifies patterns, and makes predictions, enabling businesses to make more informed decisions. - Machine Learning (ML)

A subset of AI, ML allows systems to learn from historical data and improve their performance over time, enhancing the accuracy of financial forecasts and risk assessments. - Cloud Computing

Cloud computing offers a scalable and flexible infrastructure for finance automation, allowing businesses to access financial data and applications from anywhere, ensuring continuity and efficiency. - Blockchain Technology

Blockchain provides a secure and transparent way to record financial transactions, enabling businesses to track and verify financial data with greater confidence.

Recommended Reading

Odin AI Introduces ‘Data Types’ Feature in Its Knowledge Base

How to Identify Which Finance Processes to Automate

When considering automation in finance, asking the right questions helps pinpoint the best tasks for AI task automation. Here are a few key questions to guide you:

- Is the process repetitive and time-consuming?

- One of the first things to evaluate is whether the task is repetitive and takes up a significant amount of time. Tasks like invoice processing or financial documentation often involve the same steps over and over, making them perfect candidates for automating financial processes.

- One of the first things to evaluate is whether the task is repetitive and takes up a significant amount of time. Tasks like invoice processing or financial documentation often involve the same steps over and over, making them perfect candidates for automating financial processes.

- Does the process require a high level of accuracy?

- Manual tasks are prone to human error, especially in finance where precision is crucial. Processes that require extreme accuracy, such as financial reporting or tedious finance workflows, can benefit from AI financial management, which ensures data accuracy and minimizes mistakes.

- Manual tasks are prone to human error, especially in finance where precision is crucial. Processes that require extreme accuracy, such as financial reporting or tedious finance workflows, can benefit from AI financial management, which ensures data accuracy and minimizes mistakes.

- Are there clear rules that guide the process?

- If a process follows strict rules and logical steps, it’s easier to automate. For instance, robotic process automation in financial services excels at handling tasks that are rule-based, such as invoice automation or financial statement automation.

- If a process follows strict rules and logical steps, it’s easier to automate. For instance, robotic process automation in financial services excels at handling tasks that are rule-based, such as invoice automation or financial statement automation.

- Does the process involve handling large volumes of data?

- Tasks that require processing massive amounts of data are ideal for automation. AI can sift through large datasets much faster than humans, making it perfect for tasks like financial controls and automation and real-time data analysis.

- Tasks that require processing massive amounts of data are ideal for automation. AI can sift through large datasets much faster than humans, making it perfect for tasks like financial controls and automation and real-time data analysis.

- Is the process prone to delays or bottlenecks?

- Processes that consistently experience delays such as Invoice Processing, Financial Reporting, Expense Reimbursement, Purchase Order Approvals, Accounts Receivable Collection, Compliance Checks are great candidates for automation. AI can streamline these tasks and speed up processes, resulting in faster financial reporting automation and overall workflow efficiency.

- Processes that consistently experience delays such as Invoice Processing, Financial Reporting, Expense Reimbursement, Purchase Order Approvals, Accounts Receivable Collection, Compliance Checks are great candidates for automation. AI can streamline these tasks and speed up processes, resulting in faster financial reporting automation and overall workflow efficiency.

- Does the process involve decision-making or require human judgment?

- Not all tasks are suited for automation. Processes that involve complex decision-making, strategic planning, or nuanced regulatory interpretation should still have human oversight. While AI in finance can handle data-driven decisions, it may struggle with tasks that require human intuition and judgment.

- Not all tasks are suited for automation. Processes that involve complex decision-making, strategic planning, or nuanced regulatory interpretation should still have human oversight. While AI in finance can handle data-driven decisions, it may struggle with tasks that require human intuition and judgment.

- Can the process impact your financial security or risk management?

- Consider whether automating the task can enhance security and risk management. AI systems are excellent at identifying potential risks, making processes like fraud detection and risk management highly suitable for intelligent automation in financial services.

Automate your finance tasks—talk to Odin AI!

Recommended Reading

How Invoice Processing Automation Can Save Your Business Time

Which Financial Processes to Automate

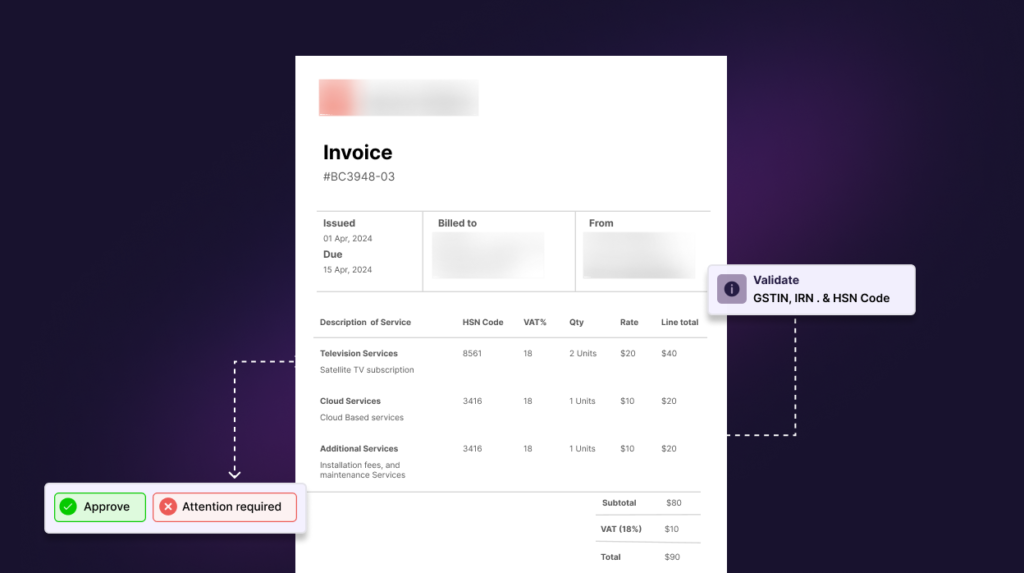

#1 Invoice Processing

The automated invoice reconciliation process is designed to match purchase orders with invoices and payments, ensuring all the data aligns accurately across the board. Accurate reconciliation contributes to reliable financial reports, which are essential for stakeholders to evaluate the company’s financial health. Using AI financial management tools, businesses can streamline this often tedious task, eliminating manual cross-checking and reducing the potential for errors. This process ensures that every purchase order is correctly matched with the corresponding invoice and payment, making sure there are no discrepancies or mismatches in financial processes.

The implementation of invoice automation for banking & financial services helps businesses manage high volumes of invoices with ease. By adopting automation in financial services, organizations can ensure that invoices are processed consistently, minimizing discrepancies and human errors.

Benefits of Invoice Automation

- Quicker turnaround times for payments.

- Improved financial accuracy and compliance.

- Streamlined workflows, reducing manual intervention.

- Enables finance teams to focus on strategic tasks.

- Reduces errors and discrepancies in invoice management.

Recommended Reading

Odin AI’s Invoice Validator: Your Path to Error- Free Invoices

#2 Accounts Payable

Accounts payable automation simplifies the end-to-end process of handling payments. From receiving invoices to verifying and processing payments, automation of financial processes ensures that everything is handled efficiently. With AI financial management, businesses can automate approvals, track payments, and manage vendor relations with minimal human input.

Benefits of Accounts Payable Automation:

- Speeds up payment processing times.

- Minimizes the need for manual invoice approvals.

- Reduces late payment penalties.

- Increases accuracy in tracking vendor payments.

- Lowers operational costs through automation.

- Improves overall financial management.

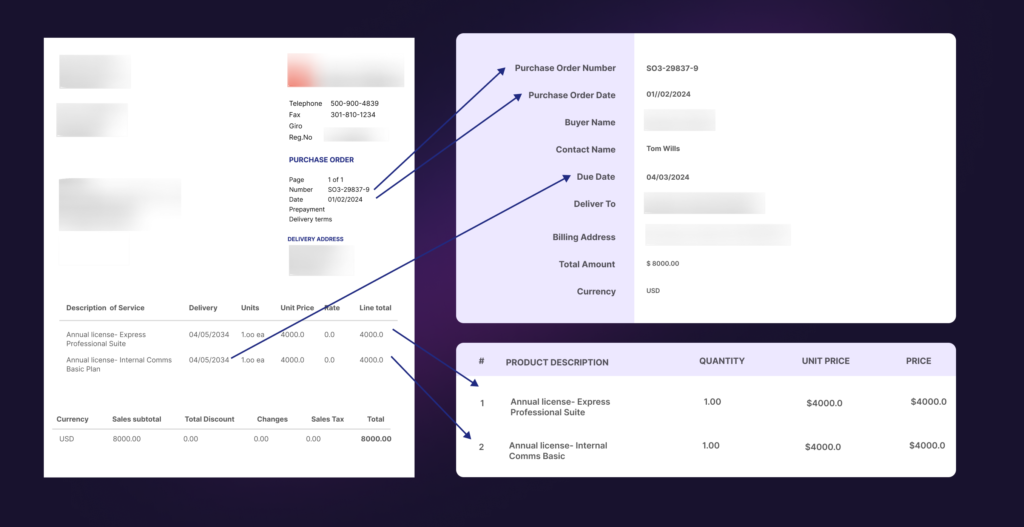

#3 Invoice Reconciliation Processes

The automated invoice reconciliation process is designed to match purchase orders with invoices and payments, ensuring all the data aligns accurately across the board. Using AI financial management tools, businesses can streamline this often tedious task, eliminating manual cross-checking and reducing the potential for errors. This process ensures that every purchase order is correctly matched with the corresponding invoice and payment, making sure there are no discrepancies or mismatches in financial processes.

With the help of AI task automation, these reconciliation tasks are handled in real-time, which speeds up the entire process. Instead of taking days or even weeks to complete, businesses can now perform reconciliations almost instantly. This is especially beneficial in industries like banking & financial services, where even small discrepancies in transactions can lead to bigger issues down the line.

Benefits of Automating Invoice Reconciliation

- Matches invoices with purchase orders and payments quickly.

- Reduces manual effort and errors in reconciliation.

- Ensures accuracy in financial records.

- Speeds up the invoice approval process.

- Minimizes discrepancies in payments and invoicing.

- Improves overall efficiency in automated finance workflows.

#4 Financial Document Retrival

With AI-driven document automation, businesses can significantly streamline how they handle financial documents. This process uses AI task automation to extract, validate, and organize data from critical documents like financial statements, contracts, and reports. Instead of manually inputting or reviewing data, financial document automation ensures that everything is accurately captured and processed. This not only saves time but also improves the overall accuracy and compliance of the information.

Incorporating automation of financial processes into document management allows companies to handle large volumes of data without overwhelming their teams. AI automation can adapt to different document types and formats, ensuring that no matter the complexity, the data is processed efficiently. This leads to faster document retrieval, better organization, and more informed financial planning.

Benefits of Financial Document Automation

- Reduces manual data entry.

- Improves the accuracy of financial records.

- Speeds up access to important financial documents.

- Ensures consistency and reliability in financial automation.

- Lowers the risk of human error.

- Saves time for finance teams, allowing focus on more complex tasks.

Recommended Reading

Financial Automation with Odin’s SQL Integration

#5 Transaction Disputes (Credit Card, Checking/Savings)

Automating the resolution of transaction disputes for credit card and checking/savings accounts ensures that customer issues are handled quickly and accurately. With AI task automation, financial institutions can resolve disputes without manual intervention, significantly reducing the time it takes to investigate and refund disputed transactions.

Benefits of Automating Transaction Disputes

- Speeds up dispute resolution, improving customer satisfaction.

- Reduces the need for manual review of transactions.

- Enhances accuracy in identifying fraudulent or incorrect charges.

- Provides real-time updates to customers on dispute status.

- Lowers operational costs by reducing manual intervention.

- Improves trust and customer loyalty through fast resolutions.

#6 Financial Customer Support Agent

Automated financial customer support agents, powered by AI financial management tools, can handle a wide range of customer queries. From answering common questions to resolving basic issues, these agents operate 24/7, reducing the workload for human agents and improving customer satisfaction.

Benefits of Financial Customer Support Agent Automation:

- Provides 24/7 customer support without human intervention.

- Handles common queries and issues quickly and efficiently.

- Reduces the workload on human support agents.

- Increases customer satisfaction with faster response times.

- Enhances accuracy in addressing financial concerns.

- Lowers operational costs for customer service departments.

#7 Fraud Detection and Risk Management

AI’s ability to detect patterns and anomalies makes it a powerful tool for fraud detection and risk management in financial services. By using AI task automation, financial institutions can scan large volumes of transactions in real-time, flagging anything unusual and potentially fraudulent. This means that businesses can respond faster to threats and protect their financial data with more accuracy.

Incorporating robotic process automation in financial services ensures that businesses can continuously monitor transactions and accounts without the need for constant manual oversight. This not only reduces errors but also enhances the company’s ability to comply with industry regulations and avoid costly financial penalties.

Benefits of Fraud Detection and Risk Management Automation

- Identifies fraud and risks faster.

- Enhances financial security and control.

- Reduces the likelihood of fraudulent activities.

- Provides real-time alerts for suspicious activities.

- Improves overall risk management strategy.

- Reduces the need for manual monitoring.

#8 Compliance and Regulatory

Automating compliance tasks with financial automation solutions ensures that businesses stay on top of evolving regulations without requiring constant manual oversight. From audits to regulatory reporting, automation in financial services takes care of the heavy lifting, keeping companies compliant and reducing the workload for compliance teams.

Benefits of Compliance and Regulatory Automation

- Keeps businesses compliant with less effort.

- Reduces the risk of non-compliance penalties.

- Automates audits and regulatory reporting.

- Saves time for compliance teams.

- Improves accuracy in meeting regulatory standards.

- Enhances overall regulatory management.

#9 Workflows of Financial Institutions

Intelligent automation is used by financial institutions to streamline complex workflows such as customer onboarding, credit scoring, and loan processing. This ensures that the end-to-end processes are handled more efficiently, improving both customer experience and operational efficiency.

Benefits of Intelligent Process Automation

- Speeds up complex financial workflows.

- Improves customer experience by reducing wait times.

- Reduces manual workload for financial teams.

- Increases overall operational efficiency.

- Enhances accuracy in credit scoring and loan processing.

- Streamlines end-to-end financial processes.

Recommended Reading

Make Generative AI Work With Your Enterprise Data Management

#10 Credit Limit Decisioning

Credit limit decisioning is another area where automation of financial processes shines. Automating the decision-making process for setting and adjusting credit limits allows for more accurate and data-driven outcomes. AI financial management tools assess credit scores, payment history, and risk factors to make decisions quickly, without manual input.

Benefits of Automating Credit Limit Decisioning

- Speeds up the process of adjusting credit limits.

- Provides data-driven decisions based on accurate financial assessments.

- Reduces the risk of human bias in decision-making.

- Enhances customer satisfaction by providing instant decisions.

- Lowers operational costs through reduced manual review.

- Improves overall efficiency in managing credit risk.

Which Processes to Leave Alone

While AI task automation and financial automation are revolutionizing the industry, not every process is suitable for automation. Some tasks still require human judgment, strategic thinking, and the nuanced understanding that technology simply can’t replicate—yet.

Strategic Decision-Making

Automation can handle a lot of the groundwork, but when it comes to high-level strategic decisions, human insight is invaluable. Long-term planning, investment strategies, and business growth initiatives need the creativity, critical thinking, and intuition that only people can bring. AI in finance might support decision-making through data analysis, but final decisions on company direction and major financial moves should remain in human hands.

Relationship Management

Building and maintaining relationships, especially in client-facing financial services, is another area where automation falls short. Financial automation tools can provide data and insights, but human interaction is key to building trust and fostering long-term relationships with clients. Personal communication, empathy, and negotiation skills are irreplaceable when it comes to working with clients or resolving complex customer issues.

Crisis Management

In moments of financial crisis—whether it’s market volatility, economic downturns, or unexpected company challenges—human intuition and experience are crucial. Automated finance systems can handle routine operations, but when facing unpredictable scenarios, human leaders need to step in. A well-rounded crisis response involves empathy, real-time decision-making, and the ability to adapt—areas where automation can’t yet match human abilities.

Need smarter solutions? Drop us a line!

Recommended Reading

How On-Prem Deployment Can Uplift Your Business

Balancing Automation with Human Expertise

Finding the right balance between AI task automation and human expertise is crucial for maximizing efficiency while maintaining the quality and insight that only people can provide.

- Automate the Tedious Tasks and Free Up Time for Important Work

- Let Humans Handle the Big Picture Decisions and Strategic Planning

- Combine AI Insights with a Personal Touch for Client Relationships

- Use Human Expertise to Navigate Complex and Changing Regulations

- Let AI Handle Data, but Humans Should Manage Crisis Situations

- Blend AI and Human Intuition for Smarter, More Informed Decision-Making

Let’s automate your finance tasks—chat with Odin AI!

Recommended Reading

IT Support Automation with Internal Helpdesk Agent

Odin Can Do It All For You!

At Odin AI, we get it—financial operations can be a real grind, with endless repetitive tasks eating up your time. That’s why we’re here, offering cutting-edge AI automation services designed to take the pressure off. Our tools help streamline your finance processes so your team can focus on the bigger picture while we handle the nitty-gritty with our advanced financial automation solutions.

Whether it’s invoice automation, financial document automation, or staying compliant, Odin AI ensures your data is accurate and your systems are running smoothly. We’ve got your back when it comes to fraud detection and risk management too, using intelligent automation to protect your business from potential risks, giving you one less thing to worry about.

At the end of the day, we’re all about helping you work smarter, not harder. With Odin AI, you can automate everything from invoice processing to financial reporting, optimizing your workflows and freeing up your time for what really matters—growing your business. With Odin AI, you’re not just automating tasks—you’re getting back your peace of mind.

Have more questions?

Contact our sales team to learn more about how Odin AI can benefit your business.

FAQs

Yes, many aspects of finance are already being automated, especially repetitive tasks like invoice processing, data entry, and compliance reporting. However, strategic decision-making and client relationships still require human expertise.

AI in finance refers to using artificial intelligence to optimize tasks such as fraud detection, financial reporting automation, and automating financial processes like invoice reconciliation and accounts payable automation.

AI task automation in finance refers to the use of artificial intelligence to streamline repetitive and time-consuming tasks, such as invoice processing, financial document automation, and financial reporting automation. This allows businesses to increase efficiency, reduce human error, and focus on more strategic activities.

You can use AI task automation to handle repetitive finance tasks like invoice automation, data extraction, and report generation. AI helps improve speed, accuracy, and efficiency by automating these processes.

While some parts of a financial analyst’s job, like data analysis, can be automated, tasks requiring human judgment, creativity, and strategic thinking are unlikely to be fully replaced by AI.

AI in finance will significantly change the way financial operations are managed, but it won't replace the need for human oversight, particularly in complex decision-making and client interactions.

An automation strategy in financial services increases operational efficiency, reduces errors, enhances compliance, and lowers costs, all while enabling faster processing of transactions and reports.

Common automated finance processes include invoice automation, accounts payable automation, financial reporting, and fraud detection. Tasks that involve repetitive data entry, validation, and reconciliation are prime candidates for AI automation in financial services.

Automating financial processes results in faster task completion, fewer errors, and significant cost savings. AI financial management tools improve accuracy in financial data, ensure compliance, and provide real-time insights, enhancing decision-making for businesses.

While many financial processes can benefit from automation, tasks like strategic decision-making, relationship management, and interpreting complex regulatory requirements still require human oversight. These areas demand creativity, intuition, and expertise that AI in finance cannot fully replicate.

Yes, financial reporting automation improves accuracy and compliance. It reduces human error, speeds up the reporting process, and ensures real-time insights, especially through AI-powered internal controls.

Business process automation improves financial management by streamlining operations, reducing manual intervention, increasing accuracy, and providing real-time data insights, which help in decision-making and financial planning.

Odin AI offers a range of financial automation solutions that are tailored to streamline processes like invoice automation, financial document automation, and fraud detection. By leveraging intelligent automation financial services, Odin AI helps businesses optimize their workflows and reduce manual effort, ensuring higher efficiency and accuracy.

Yes, AI in finance is highly effective in fraud detection and risk management. By using intelligent automation, AI can detect patterns and anomalies in transactions, enabling businesses to identify potential risks and prevent fraud in real-time.

Financial reporting automation powered by AI financial management tools helps generate accurate reports faster. It automates data collection, analysis, and report generation, allowing businesses to meet compliance requirements and make informed decisions based on real-time insights.

Digital process automation in financial services involves using AI and automation to streamline workflows, enhance operational efficiency, and reduce costs, particularly in areas like compliance, customer onboarding, and transaction processing.

Automation is crucial for financial institutions as it improves efficiency, reduces human errors, ensures regulatory compliance, and enhances customer satisfaction by enabling faster and more accurate processing of financial tasks.

The future of automation in the finance industry is focused on further integrating AI task automation into more complex processes. As AI evolves, it will continue to improve the efficiency of financial operations, enhancing areas like invoice automation, credit limit decisioning, and compliance.

Yes, financial document automation is highly reliable when powered by AI automation tools. It reduces the risk of human error, speeds up document processing, and ensures that all financial data is accurate and compliant with industry standards.

Robotic process automation (RPA) in financial services automates repetitive tasks, increases efficiency, reduces human errors, and lowers operational costs, freeing up human resources to focus on higher-level strategic work.